Budgeted Manufacturing Overhead Rate Formula

Predetermined Overhead Rate Formula (Table of Contents)

- Formula

- Examples

- Calculator

What is the Predetermined Overhead Charge per unit Formula?

The term "predetermined overhead rate" refers to the allocation rate that is assigned to products or job orders at the beginning of a project based on the estimated cost of manufacturing overhead for a specific period of reporting. In other words, it provides an guess of the expected price to exist incurred in producing a product or job order. The formula for the predetermined overhead rate tin can be derived by dividing the estimated manufacturing overhead toll by the estimated number of units of the allocation base for the menstruum. Typically, direct labor cost, direct labor hours, machine hours or prime number price is used every bit the allotment base, while the menstruation usually selected is one yr. Mathematically, it is represented as,

Predetermined Overhead Rate = Estimated Manufacturing Overhead Cost / Estimated Units of the Allocation Base for the Period

Examples of Predetermined Overhead Rate Formula (With Excel Template)

Let'due south accept an example to understand the calculation of Predetermined Overhead Rate in a improve mode.

You can download this Predetermined Overhead Rate Formula Excel Template hither – Predetermined Overhead Charge per unit Formula Excel Template

Predetermined Overhead Rate Formula – Example #1

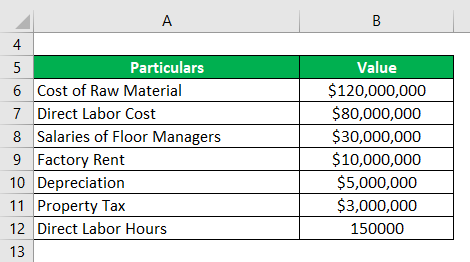

Let us take the example of a visitor named TYC Ltd that is engaged in the concern of manufacturing automotive spare parts for ii-wheelers. The company has budgeted the following cost for the upcoming year:

Further, the company uses direct labor hours to assign manufacturing overhead costs to products. As per the budget, the visitor will crave 150,000 directly labor hours during the forthcoming year. Based on the given information, summate the predetermined overhead rate of TYC Ltd.

Solution:

From the higher up list, salaries of floor managers, factory rent, depreciation and property tax form role of manufacturing overhead.

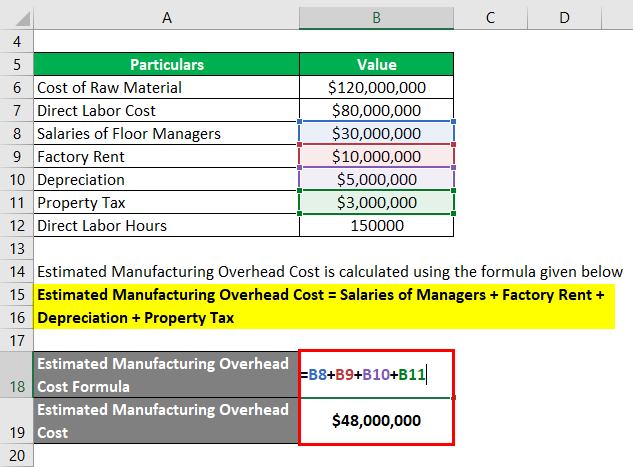

Estimated Manufacturing Overhead Cost is calculated using the formula given beneath

Estimated Manufacturing Overhead Toll = Salaries of Managers + Factory Rent + Depreciation + Belongings Tax

- Estimated Manufacturing Overhead Toll= $xxx 1000000 + $ten 1000000 + $5 1000000 + $3 million

- Estimated Manufacturing Overhead Toll = $48 million

Predetermined Overhead Rate is calculated using the formula given below

Predetermined Overhead Rate = Estimated Manufacturing Overhead Price / Estimated Units of the Allocation Base for the Catamenia

- Predetermined Overhead Rate = $48,000,000 / 150,000 hours

- Predetermined Overhead Charge per unit = $320 per hour

Therefore, the predetermined overhead rate of TYC Ltd for the upcoming year is expected to be $320 per hour.

Predetermined Overhead Charge per unit Formula – Example #ii

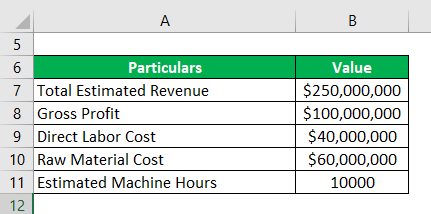

Allow united states of america take the instance of ort GHJ Ltd which has prepared the budget for next twelvemonth. The company estimates a gross profit of $100 million on total estimated acquirement of $250 meg. As per the budget, direct labor cost and raw cloth price for the catamenia is expected to be $40 meg and $60 million respectively. The visitor uses motorcar hours to assign manufacturing overhead costs to products. Summate the predetermined overhead rate of GHJ Ltd if the required machine hours for next year's product is estimated to exist 10,000 hours.

Solution:

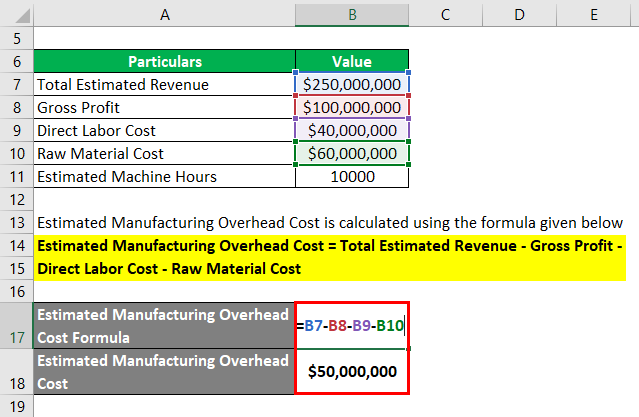

Estimated Manufacturing Overhead Cost is calculated using the formula given below

Estimated Manufacturing Overhead Cost = Total Estimated Revenue – Gross Profit – Straight Labor Toll – Raw Material Price

- Estimated Manufacturing Overhead Price = $250 million – $100 one thousand thousand – $forty million – $60 million

- Estimated Manufacturing Overhead Cost = $50 million

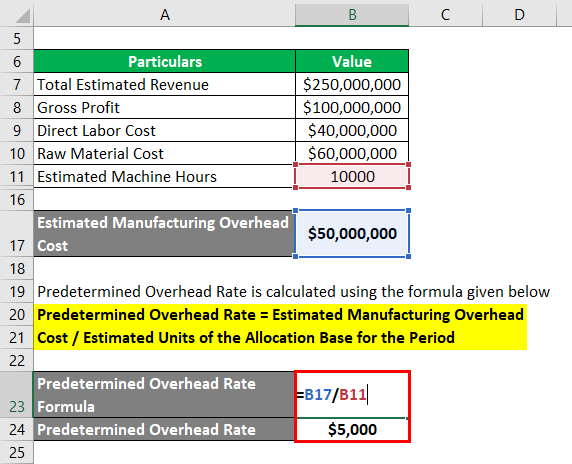

Predetermined Overhead Rate is calculated using the formula given below

Predetermined Overhead Rate = Estimated Manufacturing Overhead Cost / Estimated Units of the Allotment Base of operations for the Menses

- Predetermined Overhead Rate = $50,000,000 / x,000 machine hours

- Predetermined Overhead Rate = $5,000 per machine hour

Therefore, the predetermined overhead rate of GHJ Ltd for side by side year is expected to be $5,000 per machine hour.

Caption

The formula for the predetermined overhead rate tin can be derived by using the following steps:

Pace 1: Firstly, determine the level of activity or the volume of production in the upcoming menstruum.

Stride 2: Next, determine the estimated manufacturing overhead cost for that level of activeness in the forthcoming period. It includes all the indirect costs that are expected to exist incurred in the process of production, all the same the same can't be assigned directly to the production.

Step 3: Side by side, determine on the allocation base for the period, which can exist direct labor toll, direct labor hours, machine hours or prime cost.

Step 4: Next, decide the estimated number of units of the resource allotment base for the upcoming period, which will be either in terms of hours for direct labor hours and motorcar hours or dollars for direct labor price and prime cost.

Step v: Finally, a formula for predetermined overhead rate tin can be derived by dividing the estimated manufacturing overhead toll (footstep ii) by the estimated number of units of the allocation base for the menstruation (step 4) as shown below.

Predetermined Overhead Charge per unit = Estimated Manufacturing Overhead Cost / Estimated Units of the Allocation Base for the Catamenia

Relevance and Uses of Predetermined Overhead Charge per unit Formula

The concept of predetermined overhead rate is very important because it is used most of the enterprises as it enables them to estimate the guess total price of each task. Larger organizations employ different allotment bases for determining the predetermined overhead rate in each production department. Nevertheless, in recent years the manufacturing operations have started to use motorcar hours more predominantly as the allocation base.

However, i major disadvantage of the method is that both the numerator and the denominator are estimates and every bit such, it is possible that the bodily effect may vary significantly from the predetermined overhead rate.

Predetermined Overhead Charge per unit Formula Reckoner

You can use the post-obit Predetermined Overhead Rate Formula Figurer

| Estimated Manufacturing Overhead Cost | |

| Estimated Units of the Allocation Base for the Menses | |

| Predetermined Overhead Rate | |

| Predetermined Overhead Rate | = |

|

Recommended Articles

This is a guide to the Predetermined Overhead Charge per unit Formula. Here we discussed how to summate Predetermined Overhead Rate Formula forth with practical examples. We as well provide a Predetermined Overhead Rate calculator with a downloadable excel template. You may also look at the following articles to larn more –

- Formula For Accumulated Depreciation

- How to Calculate Existent GDP Formula

- Examples of Interest Expense

- Adding of Price Elasticity of Supply Formula

Budgeted Manufacturing Overhead Rate Formula,

Source: https://www.educba.com/predetermined-overhead-rate-formula/

Posted by: daughertyvittlentoond1970.blogspot.com

0 Response to "Budgeted Manufacturing Overhead Rate Formula"

Post a Comment